“Google has the largest capacity in terms of computing and data capacity, so it is most likely to be the leader” (Elon Musk).

The market seems to differentiate between the two “You’re Magnificent” and the truth is that the biggest initial loser of the technological revolution is today positioned as the great ganador of the AI era.

What is certain is that Google has clearly responded to the major coup that allegedly broke ChatGPT into the technology landscape. Gemini can’t stop selling the market last month and it’s doing even better, reaching 750 million monthly active users. There is an important change in the business model, replenishment publicity with strong subscription growth.

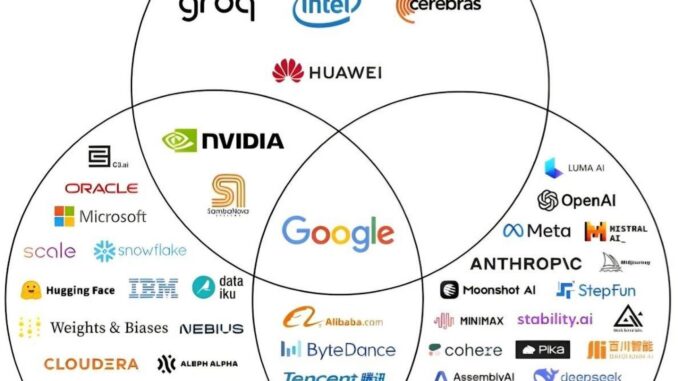

Google is de facto the only giant that vertically integrates all branches of AI:

Google is also the second company that generates the most business benefits worldwide. All the following in the classification are an integral part of “You are great”. If only it were Tesla:

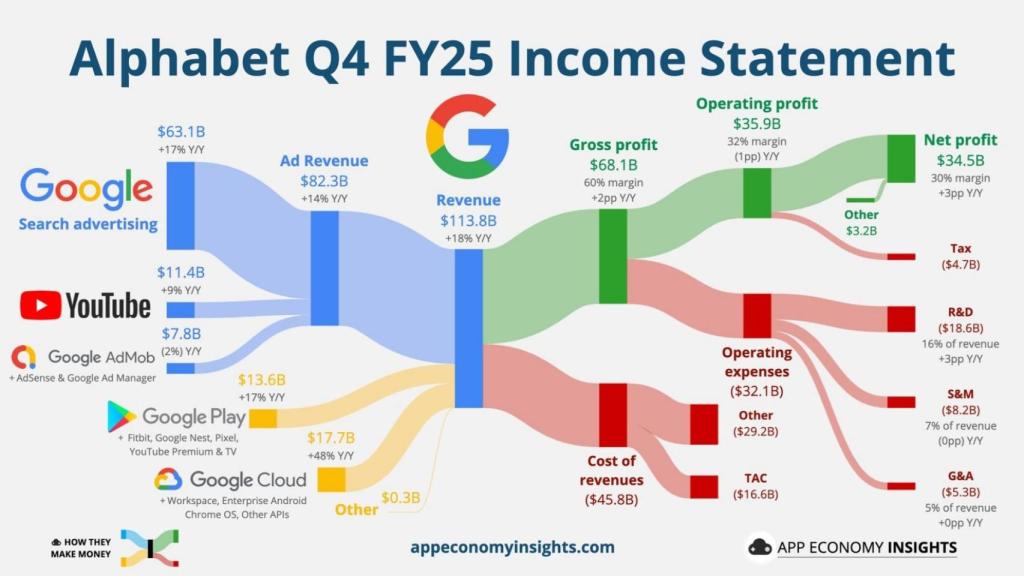

This leader in benefits is reflected in its historical figures: Google has officially surpassed $400,000 million in annual revenue for the first time.

Search is the result in AI: accelerating by 17% per year, raising $63,100 million. Deputy advisor Sundar Pichai signaled that the use of bows was at an all-time high, with the launch of Gemini 3 sparking an expansive moment instead of the dog-bait that anglers hope for. It is a good record that the market can be completely misunderstood for a long time.

Total YouTube revenue (including subscriptions) exceeded $60,000 million during the year, driven by a subscriber base of more than 325 million across all services:

Cloud is the main driver, with an increase of 48% compared to the previous year to $17,700 million (a significant acceleration from the 34% annualized rate in the third quarter). The market expected cloud to grow by 36%.

The company is currently seeing an annual growth rate of $70,000 million with a 30% margin in this segment, proving that AI infrastructure is a highly profitable business.

Cloud backlog grew 55% quarter-over-quarter to $240,000 million. This growth represents a structural change as corporate clients move from experimenting with Gemini to signing multi-year infrastructure contracts worth thousands of dollars.

Then it’s the potential of TPU (its own chips are the cheapest and most efficient to not depend on Nvidia) and Anthropic, which now includes processing 10,000 million tokens per minute.

Hyperscalers accumulate gigantic capital gases and generated money in the market before the possibility that these inversions are not profitable.

These huge inversions are done because they are not enough to satisfy the requests, not for mere fancy. Meta does this to be self-sufficient and Amazon, Google and Microsoft to be able to serve the super growing demand of companies.

Likewise, does anyone believe that the top managers of the world’s best companies do not know what they are doing and want to lose in business terms? They clearly create AI “carreteras”:

There is a fear of this huge inversion in the form of desperate profitability, similar to what happened historically in the telecommunications or railway sectors, where competences ended up benefiting only the end customer and not the company managers.

However, the AI and cloud sector will work as an oligopoly (like Visa or Mastercard) in my juice, allowing me to maintain high margins. Just a few titans will allow you to seed quantities and you will get a clear income on these inversions over a large area.

For a short time, you can afford to finance the costs yourself using cash flow completely (Microsoft) or completely cases (the rest):

Last week, only Apple got rid of the item in the bag. Coincidentally, she is the only one who left the AI track. So the market rewarded investors with opportunities to make money on the biggest giants:

Demis Hassabis, CEO of Google Deepmind and winner of the 2024 Nobel Prize in Chemistry, says of the future of artificial intelligence: “It will be 10 times bigger than the industrial revolution and 10 times faster.”

Leave a Reply