Nvidia, the most valuable company in the world, soared 7.8%. The optimism extended to Advanced Micro Devices (AMD), which jumped 8.3%, and Broadcom, with a rise of 7.1%. The Philadelphia Semiconductor Index (.SOX) ended the day with gains of 5.7%, validating the thesis that money from tech giants is flowing directly to technology manufacturers. chips.

The “floor” of correction

Although the S&P 500 Software and Services index recorded its worst week since March 2020, this Friday’s close brought a technical recovery. Companies like CrowdStrike and Palantir rose more than 4%. Speaking to Reuters, Ross Mayfield, investment strategy analyst at Baird, highlighted that “there is enough evidence that there is real demand for AI products”, which created support for investors to return to buying after Thursday’s aggressive sell-off.

LSEG data reinforces this positive feeling: with more than half of the companies in the S&P 500 having already reported results, around 80% exceeded analysts’ expectations, a value significantly above the historical average of 67%.

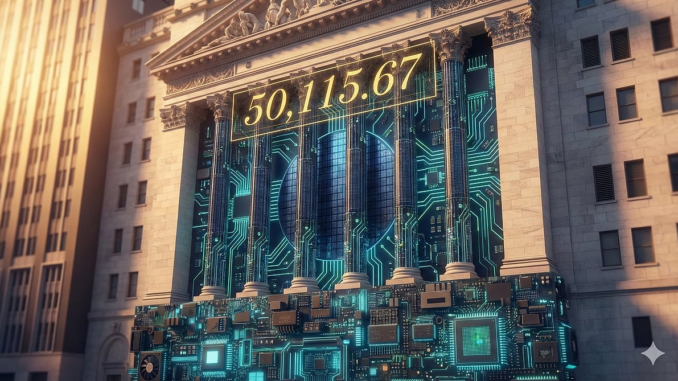

Diversification and records

The day was not just marked by technology. The rise in the Dow Jones also reflected a flight to more traditional sectors. According to the market data cited, the Energy, Industrial and Consumer Staples indices also reached historic highs.

The balance of the week, however, remains mixed. While the Dow Jones added 2.5%, the Nasdaq, more exposed to the software which on Thursday was under fire, ended the period with an accumulated loss of 1.9%, confirming that the AI ”hangover”, although mitigated, still dominates Wall Street’s concerns.

Leave a Reply